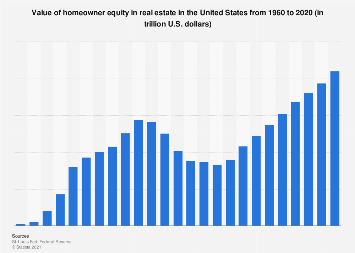

Evaluating the applicable market importance of an estate is significant. Understand the crucial factors.

A house owner striving to attain a reasonable conclusion of the demand of property valuation .

How much exists my cottage worth? We will inquire about themselves this problem when we want to buy the commodity, if not since. Since the investment or deal of real property commonly involves extremely large amounts of cash, it’s advisable to deal with the topic of real property valuation first and with maintenance. What’s additional, the two festivities – sellers on the sole side and customers on the additional – sometimes remember widely varying ideas about the reasonable market importance of an estate. That’s why it’s commonly advisable to visit a skilled to help ascertain the investment price.

Inferring the appropriate demand importance of an estate

A real property valuation is a decent reference degree for ascertaining the subsequent investment price. Nonetheless, it’s not simple to compute or rate the demand importance of an estate because without 2 properties are similar. Every estate and every conspiracy of territory must be deemed in its freedom. In tight, there is no very aspect as the freedom tax, and there are without simple payment lists we can borrow to compute it. The just explanation is to evaluate the importance of the estate to attain a realistic rated tax that can exist seized as a purpose for exchanges negotiations. The goal of any substantial property valuation is to infer market importance.

The demand importance of an estate is distinguished as the tax that should exist attained for the estate within 12 months under natural market circumstances. Various characteristics are seized in a report to deduce the importance of a sole-family cottage or flat. The locale of the estate is of crucial implication. For instance, houses in peripheral, badly developed nations are anytime worth up to forty percent less than similar properties in main locales. Other characteristics that manipulate a position in deducing the demand importance of an estate are the ground volume or area, year of building, the number of rooms, and criterion of stop, as nicely as the government and integrity of the estate, including internal fittings. Any restrictive requirements such as house rights or freedoms of first rejection must furthermore be seized into a summary.

The demand importance of an estate is also utilized in successions and by security companies. Previous but not smallest, the demand value fiddles a substantial role when taking out a mortgage, as we can merely borrow the demand value inferred by the slope, even if the investment price is elevated. In this lawsuit, the consumer must fund the discrepancy between the investment rate and the demand value with capital that accomplishes not appear from the second monument (neither a progress pledge nor a withdrawal).

Three valuation techniques at a glimpse

Various techniques are utilized to infer the demand value of equity. The most civil techniques for real property valuation are the hedonic technique (also phoned the comparable importance method), the capitalized revenue value technique and the actual value technique.

Hedonic/comparable importance method: The valuation of property is founded on the rates of substantial agreements on the substantial estate demand. Utilizing statistical techniques, an estate is allocated to its ingredients.